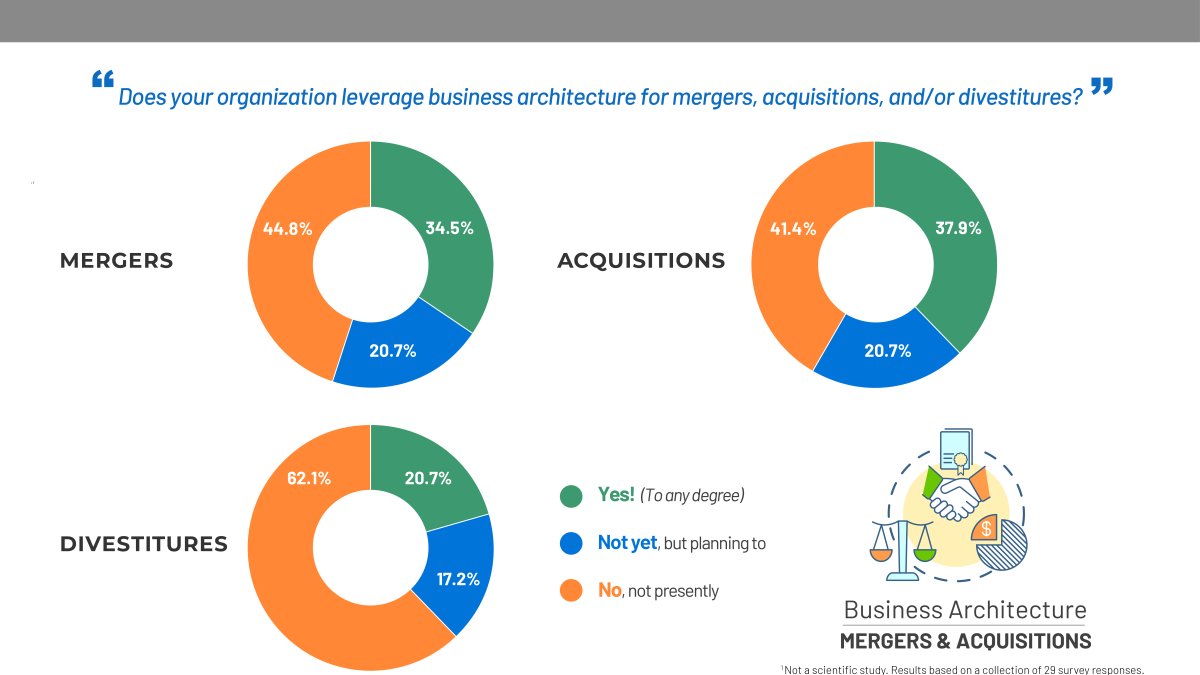

The survey shows that 34.5% / 37.9% of organizations are leveraging business architecture for Mergers / Acquisitions to some extent, while another 20.7% are planning to. Still, over 40% are not planning to leverage business architecture for Mergers / Acquisitions at this time (which may in some cases may simply be because M&A is not relevant to the organization).

Fewer organizations are using or planning to use business architecture for Divestitures (which again may in many cases be due to a lack of relevance). The survey shows that 20.7% of organizations are leveraging business architecture for Divestitures to some extent while another 17.2% are planning to. Still, 62.1% are not planning to leverage business architecture for Divestitures at this time.

Selected comments from respondents are below:

- “We don’t plan to merge, but grow by organic and inorganic acquisition. Business architecture is our transformation framework for both organic and inorganic growth.”

- “We use a portion of the Capability Catalog to drive discussion and assessments.”

- “We leverage it to assess and identify mutual capabilities as well as for a software rationalization exercise during integration.”

- “Though business architecture is being used to plan out an acquisition, it is being used bare minimum.”

- “My organization leverages business architecture POST any acquisitions or divestitures in order to assess impacts and identify operational efficiencies and risks. We are not at the table "prior-to" or "when" the decisions are being made.”